Episode Transcript

Transcripts are displayed as originally observed. Some content, including advertisements may have changed.

Use Ctrl + F to search

0:05

Welcome to StartupRed.io, your podcast and YouTube blog covering the German

0:12

startup scene with news, interviews and live events.

0:19

Hello and welcome everybody to StartupRed.io. Today we're diving into the world

0:25

of venture capital with Identity VC. Joining us is Till Klein. Hi, Irene.

0:32

Hi, Joe. How are you today? Doing good, thank you.

0:36

You are the founder and managing partner of Identity VC, a VC firm redefining

0:41

investment in early-stage startups.

0:44

In 60 seconds, Till, can you share what sparked the idea for Identity VC and

0:51

what problem you're most passionate about solving?

0:54

Sure, happy to. Yeah, IdentityVC invests in LGBTQ-led companies.

1:00

And the thesis behind that is that innovation thrives when we break from the norm.

1:08

And for the LGBTQ community, breaking the norm is part of our DNA.

1:15

So our thesis is that LGBTQ founders are born to disrupt.

1:20

And this is a great untapped opportunity as an investor, full stop.

1:28

That's why we do it and what we do. For our listeners, what's the biggest challenge you think early startups face when securing funding?

1:41

Let us know in the comments down here.

1:45

Talking a little bit about your journey, your origin, your story, your vision.

1:52

Before we got into the recording, we talked, you already had a successful career

1:57

before founding IdentityVC, working, for example, with BCG.

2:04

What was the catalyst that led you to launch this venture fund?

2:08

Yeah, it's kind of, you need to go back to, so I started, actually,

2:12

I wanted to work for a bank. When I was at university, I wanted to work for a bank.

2:17

But I finished university in 2022. There was no jobs available in banks.

2:22

So that's how I ended up with BCG.

2:24

I never regretted it. And I had a good time. And I stayed there for more than 12 years.

2:33

But I've always focused on financial services.

2:36

And at some point when left and right, the fintech wave started,

2:41

I saw my clients doing nothing and got a bit frustrated. And so that triggered

2:48

me to start my own company, Fintech company.

2:51

And so that's also how I met my now co-founder Jochen.

2:57

He is a family office investor out of Berlin.

3:00

And we both came across an organization called GANGELS in the U.S.

3:07

That's initially gay investors who invested into diverse founders.

3:15

And I came across them when looking for funding.

3:21

Jochen, as an investor, as a co-investor, he did a lot of co-investments with

3:24

them. And we asked ourselves kind of, why is there nothing similar in Europe?

3:29

And so that was back five, seven years.

3:35

And then kind of we didn't find a reason why not.

3:39

The only reason is probably nobody did it. So then we were waiting for a while

3:43

if somebody does it and nobody did it. And after I closed down my startup,

3:49

we then said kind of, let's give it a try.

3:53

Now I've got some time. And obviously, it's on us to start that idea in Europe.

4:01

That already kind of gets my next question.

4:06

Which gaps you saw? It's especially the LBGGQ founders that you are looking

4:14

for from our discussion before.

4:17

My understanding is that at least one of the members needs to identify as LBGGQ,

4:24

but everything else is just a normal startup.

4:28

You're also looking at the normal business projects there and stuff.

4:32

Absolutely, absolutely. So actually, there was no fun focusing on the LGBTQ

4:39

or queer community. It's sometimes easier than the acronyms.

4:44

But the opportunity is huge. So we estimate that 18% of the startups do have an LGBTQ co-folder.

4:53

And this is even growing, given the fact that in younger generations,

4:58

more people are identifying as queer. So this is a huge untapped opportunity as a VC.

5:05

And if you compare that, that's more or less the same size as the fintech market.

5:13

So it's a huge, huge opportunity.

5:18

You came from BCG, then you tried fintech, and then you started a VC fund.

5:24

I think that's quite an interesting journey you have behind you.

5:30

But what was the biggest challenge in building a VC firm that stands out in

5:36

a very competitive industry?

5:38

We do get, I would say, at least once a week mailings from some new fund that

5:47

was either raised or completely new VC firm launched.

5:51

So it gets more and more competitive, which, by the way, is for Europe a very

5:55

good thing, because there's a lot more startups that need funding than there are VCs right now.

6:01

But what we say kind of stood out as like the one, two or three top challenges you face there.

6:10

Yeah, let's say, kind of, I wouldn't have started if the opportunity wasn't so obvious.

6:17

Because honestly, starting a generalist fund in Europe at the moment, I wouldn't do that.

6:25

I do not recommend it. But here was really an opportunity that was very obvious

6:29

and nobody has taken it yet.

6:32

On the other hand.

6:36

We also were a bit naive when it came to the fundraising environment and coming

6:42

from 2021, 2022, where capital was available easily.

6:48

And so we were over optimistic at the end.

6:53

So fundraising was just a bigger effort than we thought.

6:59

At the end, if I look left and right and how many funds I saw who started earlier

7:05

than we and who are now behind us or who have given up.

7:12

So I'm pretty satisfied with what we've achieved so far.

7:17

But that definitely was in that environment to raise a fund is a tough cookie

7:24

coming all with what comes with a fund.

7:27

So it's kind of you need to build the organization, you need to build the network, and all that comes.

7:34

And all that without having any income, that's also kind of – that's a big structural problem for VC.

7:42

And that prevents a lot of, let's say, uncommon people to get into VCs because

7:50

at the end, you need to be able to afford it.

7:52

And because fundraising takes two years and there's during those two years,

8:00

there's no income, but a lot of costs. So that is kind of so Jochen and I, we are a bit older and so we could afford it.

8:11

But that's a big challenge, particularly for younger VCs.

8:17

And that prevents probably quite interesting VCs. I would love to see in Europe.

8:26

Before we get to my next question, do you have any idea how one could encourage such VCs?

8:35

Oh, pretty sure. So honestly, European VC is primarily public funding.

8:43

So it depends on the vertical, but overall across all, it's over 30% is public

8:48

funding. So that always we need to keep in mind.

8:52

And so the question is kind of behind the public funding, what you want to achieve.

8:59

And if public funding would be kind of focused on that and would drive new,

9:07

for unconventional VCs to come up, that would work because they could put their money there.

9:14

They don't do that, to be very honest.

9:17

They prefer to throw their money after those who are already big.

9:22

But that's a political decision, a wrong decision from my perspective.

9:26

But that could change. How that could work, you see, it's about defense tech.

9:35

So defense tech was not big. And then there was a lot of public money turned

9:40

towards that direction, and that immediately shifted the whole industry in that direction.

9:46

So they do have, they could play, given the fact that they are so strong, play an important role.

9:53

Unfortunately, when it comes to new VCs and new ideas, they're not really open.

10:01

They prefer to sit in the board of the established VCs or on the advisory board.

10:07

When you've been talking about starting Identity VC, you talked about you would

10:13

not start a general VC fund right now in Europe.

10:17

That got me curious. What kind of VC fund would you start right now except for Identity VC?

10:25

What kind of VC fund I would start?

10:30

I haven't thought about it. Honestly, these kinds of things are very opportunity-driven.

10:38

And honestly, if there would not have been the opportunity and there would not

10:42

have been Jochen to do that together, I would not have done it, probably.

10:47

So it's kind of have the idea, the opportunity, and the team.

10:53

And honestly...

10:56

And there is none. So I don't think I need to start a second FAT at the moment.

11:04

So I'm still busy with the first one. I do believe so.

11:09

Let's talk about a little bit of the industry market landscape, the competitive edge.

11:14

You are described as investing in startups with a strong market fit and unique identity.

11:20

What defines a strong identity in a startup?

11:26

A strong why, a strong mission. Why are you doing this?

11:32

What's the mission? And founders who really know they want to change something,

11:37

they want to build something, except from getting rich, which is not,

11:41

from my perspective, a very strong mission, at least kind of in terms of pushing a startup through.

11:50

We've been talking about your main investment focus, but there are also,

11:53

of course, different industry, different trends. Think about like all the things

11:57

we've seen in the past, e-commerce, fintech, quick delivery,

12:01

drones, and so on and so forth.

12:04

How does IdentityVC position itself in this evolving landscape?

12:09

Are you looking on a deal-by-deal basis? Or are you already seeing what could

12:16

be the next trend, what could be the next interesting wave of startups?

12:21

Lots of buzzwords, which is kind of, yeah, very kind of that characterizes the VC industry.

12:29

Kind of there's lots of trends and fashions and then everybody is chasing that.

12:33

So typically the most VCs are not very good in risk taking and taking new opportunities,

12:38

which doesn't make any sense because that's a job of VC.

12:41

But I was I've never understood.

12:45

So you want to go for the stuff others don't look at. And honestly,

12:49

if you look at the history of VC, that's also how big VC firms grew,

12:54

because they took a decision that was against the market.

12:57

But so to answer your question, what we do is we are generalists and decide deal by deal.

13:07

So we are open for plenty of opportunities.

13:12

And so that also comes with a challenge in terms of you need to have the expertise,

13:16

you need to have a great network.

13:19

But as we have that kind of very narrow focus on kind of what type of founders

13:24

we're looking at, we decided, okay, we need to be a bit broader when it comes to industries and that allows

13:30

us to see very, very interesting stuff, particularly for a guy who has a banking

13:37

background, which is like very boring,

13:40

very kind of always the same, a very simple industry.

13:44

And now I have the chance to look at quite exciting startups who have really

13:52

impact and can make a big difference to people.

13:58

You guys are investing in early stage startups. What would you say is,

14:04

especially from the side of

14:06

the founders, the biggest misconception about early stage VC investments?

14:13

And one thing that jumps to my mind is when they ask me to sign an NDA,

14:20

which is like, and that shows there's no lake of ideas. And an idea is worth nothing.

14:26

It's all about the execution. I've seen so many ideas that never happened.

14:31

And this is quite often you see that from unexperienced founders.

14:37

They come and say, can you sign an idea? and this is honestly,

14:42

you're just talking about a brainchild and,

14:45

there's nothing if you are not able to execute on that, it's worth nothing so

14:51

this doesn't make any sense.

14:54

So they learned that very fast because no VC would ever sign an NDA at that

15:00

stage but it always gives me a smile when they come up and say, can you sign an NDA?

15:06

It's like, no I was the same when I started my startup and you were an unexperienced founder.

15:11

I did exactly the same. I see. So we're all learning. Hopefully a lot of future founders listen to this

15:21

episode and already learn from the mistakes of others.

15:26

I want you to close your eyes and imagine something.

15:30

Imagine Identity VC has backed the next generation of unicorns.

15:34

What key industry shifts would have made this possible?

15:39

I would say it's clearly AI at the moment. It's kind of not industry-specific

15:43

that will impact across industry. That's really like having even a broader impact than Internet had 30 years ago

15:51

or 25 years ago. So, no, 30 years.

15:56

So, shit. That reminds me how old I am. But this will have such an impact on so many industries,

16:08

starting from financial industry, health, but production.

16:13

This will be very fundamental, and we are just at the beginning.

16:18

Actually, about being older, just a friend of my wife, she has a girlfriend,

16:25

and the kids are teenagers. And I told them, I'm older than Google. And they said, no way. And I said, yes way.

16:33

That is really old Jill we will be back for our audience with your investment

16:38

thesis and startup selection deep dive after a short ad break.

16:51

Hey guys, welcome back to the interview with Till from Identity VC.

16:55

We are now talking about investment thesis and startup selection.

17:01

Till, what are the top three criteria that determine whether Identity VC invests in a startup?

17:10

We already heard it's not the idea, it's the execution, but what else?

17:16

It's pretty clear. There needs to be a real problem. You need to solve a problem for somebody.

17:23

Secondly, there needs to be a market and a big enough market.

17:26

If there's no demand or nobody is paying for a solution for the problem or it

17:32

is too small, it doesn't work. And thirdly, it needs a great team that executes it on it and solves the problem.

17:41

That is great. It seems like you have seen my next question because beyond the

17:47

numbers And be honest, in early stage VC investment,

17:50

the numbers are not that important here because the real revenues will come in the future.

17:58

What are some intangible qualities you look for in a founding team?

18:06

That's what I mentioned before. It's kind of mission driven.

18:10

I think that's very, very, what's the motivation? Why somebody started the startup?

18:14

So I think that's a very, very interesting question to understand the startup.

18:19

And why are you so crazy to go through all the pain?

18:24

So you need to have a very strong motivation. And second is risk taking.

18:29

You need to be willing and able to take crazy risk.

18:34

And everybody around you will advise you not to take that risk.

18:38

But then you are exactly on the right way.

18:41

If everybody is disagreeing with you, go ahead. You are on the right way.

18:46

And that combined with a hustler mentality, at the end, it's like there's nothing to delegate.

18:54

Hate this, just get, roll your sleeves up and go create results and create them fast.

19:02

By the way, mission driven. That made me smile because being rich quickly is not a mission here.

19:14

It is. Honestly, that drives some founders. Yes, it does.

19:20

This is not a company I would invest in.

19:24

Yeah, so the getting rich is all good. And honestly, we're not good in Europe.

19:28

So that's kind of for all the pain and all the risk you take,

19:32

there needs to be a proper reward.

19:36

And that's a big problem in Europe that the reward, particularly not only for

19:42

the founder, but kind of for kind of the management team, is not enough.

19:51

But that's not enough to build a great company and to solve a real problem.

19:57

I was smiling because I found when you have somebody in the team who wants to

20:04

get rich quick, he or she takes the earliest possible exit,

20:11

during semi-retirement or something that is not the people who really want to

20:16

build a unicorn to the end. Um,

20:19

How do you balance investing in visionary founders versus proven traction?

20:25

I don't balance. 100% vision.

20:27

Okay. What role? We talked about this before.

20:33

You and your team, obviously, like I do, use AI.

20:37

And what role does AI play in your investment decision-making process?

20:42

Do you leverage AI to analyze deal flow or market trends?

20:46

It would be a lie if we don't. Can we do more?

20:50

Honestly, we can do more, more systematically, more do kind of the routine task.

20:56

So kind of what, honestly, what in previous times an intern did or so,

21:03

that's all stuff that you can do or an assistant that you can do with AI.

21:07

At the end, AI is not yet there that it can take an investment decision from

21:14

my perspective because AI can do a lot, but it's not intelligent yet.

21:20

And I always have the discussion with the team to say kind of this is all good market research.

21:26

But honestly, to nail that to the point and draw a conclusion,

21:31

a business and really an investment decision, this is missing.

21:36

And this is what you cannot yet get out of AI.

21:40

That's where the human factor comes in. I was smiling when you talked about the intern, because if you can describe

21:46

a to-do in a way that an intern would get it, you can also delegate it to an AI.

21:53

That's a very, very good point.

21:57

And honestly, I see that and I've experienced that so often that you get something

22:02

and you think, what the fuck is that?

22:05

And then you just have to hold your own nose and think, shit,

22:11

this is what the briefing I gave. I gave no briefing.

22:15

So bullshit in, bullshit out. And that's exactly what's happening in much faster pace.

22:19

So you get more faster feedback, but that also happens if you don't give proper

22:26

briefing to your team and the more junior they are,

22:30

you get non-optimal results.

22:36

I see. Let's talk a little bit about business model and growth strategy here.

22:42

VC is evolving. How do you see traditional VC models changing over the next five years?

22:49

As we already talked, AI will have an impact.

22:52

I do believe there's some overvaluation in AI, but we're just at the start of

22:58

learning how to really apply it. And the development is already in the future here.

23:03

So how do you see the traditional VC model changing?

23:07

First of all, I would challenge your point that VC is evolving.

23:12

This is a very conservative industry, which has not much involved over time

23:17

and has not much changed.

23:19

So it's dominated by white old men and public institutions.

23:24

And they are typically not very the change drivers. And so is the industry.

23:33

The only shifts we've seen is kind of what I mentioned a bit earlier is kind

23:37

of when there was a shift by public funders. Kind of defense tech is a good example.

23:42

So they shifted their money. That was like a big boom in one direction.

23:46

And everybody is running behind them or following them.

23:52

But at the end, if you look at things like women in BC, this is ridiculous what

23:58

happened the last 10 years. If you look at top ranks, the share of women in VC has grown from 2011 to 2021 from 9% to 12.5%.

24:15

This is fucking ridiculous. If you project that in the future,

24:19

it would take another 107 years to get to parity.

24:24

So this fucking industry is not changing at all.

24:28

And this is all lip service and kind of we get more diverse. No, you're fucking not.

24:34

So you are at a lower double digit number of female and not talking about other

24:42

diversity dimensions. But there's, for obvious reasons, more data available.

24:49

And that's also true to other stuff. So this industry is ready for disruption as well.

24:57

And when you talk about public investors, one should keep in mind that you're

25:01

not only talking about the legal entities here involved in Europe,

25:06

But also, you should keep in mind that a lot of the big VC funds in the U.S.

25:11

Are basically backed by something like the Teachers Retirement Fund of California,

25:17

Ontario Pension Fund of Public Employees, or something like that.

25:20

You should always keep that in mind.

25:24

It's important, but that's a political issue, that in the U.S.

25:29

Kind of pension money, and that's the biggest pool of wealth, flows also into VC.

25:36

And that's a big problem of Europe that policymakers have not understood that

25:41

this is the lever. The only who has understood that is Macron.

25:44

Can debate about him, but that's what he did very right.

25:48

He forced kind of the insurers to put more money into BC and kind of look at

25:54

the numbers that in the meantime, Paris has overtaken Berlin.

25:59

That's one of the reasons why. Mm-hmm.

26:03

So what's your take? I mean, as a traditional VC, what's your take on alternative

26:10

funding models like revenue-based financing or, for example, crowd investing?

26:16

We put a lot of hope in crowd investing, but right now it's more a proof of

26:22

interest by potential community, by potential audience.

26:26

Like a first step to raise venture capital. I've seen it so far.

26:31

Yeah, it's good to have some that never took off.

26:35

Obviously they're not the solution because what we need is funding below VC

26:41

level so we see a lot of great founders with great cases but they're not a VC

26:48

case they might become a company that's worth 80,

26:52

100 million or 100 million which is fucking successful which is great but it

26:59

doesn't work for the math of a VC fund,

27:02

This is just kind of you need to really chase for the unicorns.

27:06

Otherwise, the math don't work. So what we do need and what is not yet available is really kind of VC-like money

27:15

for kind of this level below VC case.

27:22

These 50 to 100 million companies and there's a big gap. and both models you've

27:30

mentioned don't solve that. You're a former consultant, so I can already guess the answer,

27:39

but how do you support your portfolio companies beyond just capital?

27:43

You mean I throw slides on them? Yeah, first of all, we can, yeah, I would say as every other top VC,

27:55

We can help them with funding, with operating support, with strategic advice.

28:02

So Jochen brings an incredible experience in fundraising.

28:07

So he himself has invested over $100 million into VC.

28:11

At the same time, he is an LP in over 20 funds in the U.S. and in the EU.

28:18

So he has top connections and something that...

28:22

It's not so common also into the family office world, which is very difficult to get in for founders.

28:30

Mari has a very good operating experience. So she was a growth operator,

28:35

scaled a company over a double digit in ARR.

28:40

You mentioned I have a consulting background and was a founder.

28:47

But that's all I would say you could expect from a VC and other VCs have as well.

28:53

So what we do have and others don't have is the LGBTQ community.

28:59

And so our intention is to help our founders to make the community their unfair advantage.

29:08

And this is a super interesting community because it's huge.

29:12

It's across borders. It's across hierarchies.

29:16

And it's cross-functional silos. So this is a great, great network,

29:22

which most owners have not yet properly leveraged and to get access to experts,

29:29

to mentors, to corporates.

29:31

We have in end of February, we have an event in Amsterdam. I'm super curious how that will work,

29:36

kind of connecting LGBTQ founders with companies, with the Pride networks and

29:42

the companies, And which is great because typically a company is a black box

29:46

for a founder and very difficult to get into this huge black box.

29:51

But the pride network in a company could give you a great network already in

29:56

the company that might not exactly the right person who is in charge of what you need.

30:03

But they're very open to help you, to guide you through the organization.

30:08

And this is a huge opportunity.

30:11

And our intention is and our mission is also to open that up for our portfolio

30:18

companies, but also beyond. I see. To our listeners, if you were a startup founder, what would be the biggest

30:28

challenge in raising VC funding? Let us know.

30:32

To you, what do you think is the biggest challenge of startups they face when

30:40

scaling, meaning they have the first investment,

30:43

they have the first product, and then they want to go big, they want to scale.

30:48

What is usually the biggest challenge they face and how do you help them?

30:52

It's a very different thing if you're an early stage startup and you are kind

30:56

of a bunch of friends, a team, and you do something together.

30:59

And it's super easy because you just need to turn around and you speak to another department.

31:05

Building an organization, recruiting, building an organization,

31:08

building a culture, that's a big challenge and that's a complete different animal.

31:14

And that's something you need to be able to. you also need to like.

31:18

So for example, I know that's not my kind of thing. That's consulting doesn't work like that.

31:24

Also, VC doesn't work like that.

31:27

So I like to have high speed, small teams where everybody kind of is in charge.

31:32

But to really scale, you need to build structures. You need to build processes.

31:38

You need to build a culture that makes these structures work as you want that.

31:45

So that's a big challenge. What we can do is we can be a sparring partner.

31:52

That's the thing. And this is anyway kind of how I see also value creation to founders.

31:57

It's they need to come to us. I don't want to obstruct help.

32:02

So they need to come to us and happy to give my opinion.

32:07

I've seen a lot of large organizations.

32:11

Jochen has seen a lot of startups also growing exactly. and he has exited large startups.

32:18

So he has seen what challenge these are. And I would say it's worthwhile talking to us about it.

32:27

I see. Let us go a little bit into fundraising and financial sustainability,

32:34

especially for the startups. You've worked closely with early stage startups.

32:38

What's a common mistake founders make when pitching a VC?

32:45

So it's quite often, but sometimes you have to be too creative when it comes to their pitch deck.

32:52

It's like the pitch deck is something that you want to look for.

32:57

You look for a certain set of information to do your first screening.

33:01

Don't be creative. Just have the information I'm looking for.

33:05

If it takes me too long to look for the information and if I'm not able to understand

33:10

the product, the market, it's super simple in a few minutes.

33:14

Then this is not a good sign.

33:18

That does not mean it needs to be professional and also to get across kind of

33:23

your branding and the shape that's kind of I'm able to do that.

33:28

But sometimes too tactical, too creative decks, just do your homework.

33:34

And that's because the first step is very technical in VC.

33:41

You see, we see 10, 20 decks per week.

33:44

So, screening it, you look for certain information, you take a decision,

33:50

do we want to talk to that team or don't we want to talk to that team?

33:55

If it takes us too long to figure that out, it's a default no.

34:02

I see. You've been talking basically about keeping your first pitch deck boring,

34:09

but what was the stand-up pitch you've received that really struck you? So far, none.

34:17

I've seen good pitches, yeah, but there was not the – I'm still waiting for

34:24

the real moonshot pitch that blows me away.

34:27

They were all, like, better or worse, but there was none that's,

34:33

like, completely thrown me away.

34:38

Great. We'll be back with team and leadership after a short ad break.

34:49

Hey, guys. Thanks for staying on. I'm talking with Till in, I think,

34:55

more than 35 minutes already here in the recording.

34:58

We are talking about now, Till from IdentityVC, I have to say,

35:03

and we're talking now about team and leadership.

35:06

I would be curious what one leadership

35:09

lesson is you learned while running IdentityVC, not BCT, not FinTech.

35:17

I i'm probably the the wrong person

35:20

to ask i'm a really bad leader so

35:23

if you you know this this linkedin things kind of good and bad leadership and

35:29

then there's this bad leadership that's all me so i would say um i i'm not a

35:35

role model here and i'm also too too old to to change uh fundamental things here.

35:42

You always learn, but I would not say that my leadership style is a role model.

35:49

I see. So then quickly shift into the culture.

35:53

What would you say are core values that define the culture at your company?

35:58

What sticks out is to be a super entrepreneurial, and that's kind of also what aligns Jochen and me.

36:04

We are very different in terms of how we work, But we are super aligned on the

36:08

mission, but also on the values, what we accept.

36:12

And part of that is entrepreneurial. Do new opportunities.

36:16

So I'm a big fan of don't ask for permission, ask for forgiveness,

36:21

just do it. Only result count.

36:25

And what I often come across in that industry is that they tell,

36:29

yeah, but others do it like that. I don't care about how the bullshit others do. That's not an excuse not to do

36:37

it better or to do it right. And I hope that's also a bit of the culture we have at Identity VC.

36:45

We not just, and that's what you see quite often in VC, just copy the bullshit

36:50

that the whole industry does. We do things differently.

36:53

Yeah, I see this in the news, of course, always the trends.

36:57

Yeah, you have like three, four big investment in one area within a month because

37:02

they heard, hey, they do it. Yeah, we also had a startup pitching. Let's do also that.

37:09

We've been talking before about the leadership and the team.

37:12

And how do you assess whether a founding team is resilient enough to navigate

37:18

the startup challenges? It's a very good example for what we just discussed, because that's what we do very differently.

37:28

We do BCG McKinsey-style case interviews with the team.

37:34

So once we've done all our homework, so we looked at the market,

37:37

we've gone through all the Excel sheets and talked to the founders quite often about the company.

37:42

Then we invite the team to us. They come to Berlin. Then, first of all,

37:47

we have a dinner together, not

37:49

to talk about the company, just to meet the team. What are the hobbies?

37:54

What's the background? To meet the person behind, because at the end you invest in the person.

38:01

And secondly, the next day we do interviews and case interviews.

38:05

And this is nothing you can prepare for. That's really kind of real.

38:09

We take real life examples, put them in front of the founders and see how they would solve it.

38:16

And what we want to get out of that here is kind of how ready they are to take risk.

38:23

Do they have a bias for speed and for results? All the capabilities we spoke

38:28

earlier about to figure that out.

38:32

And that works super well because founders stop,

38:36

try to sell their company because they just kind of, you confront them with

38:41

a question they will come across anyway in the future and see how they react.

38:47

And this is turned out to be a fantastic way how to evaluate founders.

38:53

So this is something I took from my BCG time with me and brought it to BC.

39:00

Interestingly, I haven't seen any other VC who does it, although it's very obvious.

39:07

Let's talk a little bit about regulatory and societal impact.

39:12

Do you see regulatory trends affecting VC investment strategies in the coming years?

39:20

Regulatory one, very much so, of course. There's a lot. But I would say kind

39:26

of it's more political, even though kind of one level up, because we are at a turning point.

39:32

Trump has terminated kind of the social contract between nations.

39:38

So if you think based on the Swiss philosopher Jean-Jacques Rousseau,

39:44

his idea of having a social contract that...

39:51

People agree on rules to gain more freedom.

39:57

And that's kind of how society works.

40:01

That's how a state works. And since World War II, we had that also on an international level, kind of.

40:06

You agree on common rules, and that gives everybody, all nations,

40:12

more freedom. That is changing.

40:15

Trump is somebody who said, I don't accept the rules anymore.

40:18

So he stopped playing by the rule. And immediately, we are back to what Thomas

40:26

Hobbes described as man is a wolf to other men.

40:31

And so, I don't know if that translates to German, but the car is getting reshuffled here.

40:37

And that will have huge impact on many industries, on the society,

40:45

and with that also on the VC industry.

40:47

I do believe it will also have an indirect impact on the European startup scene

40:53

made before the VCs from the US directly investing in European startups,

40:58

as well as the LPs investing in European-based funds.

41:03

Absolutely. Absolutely. Because you see that will reshuffle what was common

41:11

practice for a while and it will stop trends and reverse trends.

41:16

And so I don't know if we get to a new level of rules,

41:21

but first of all, there is somebody who just breaks the common practice,

41:30

and that will definitely have a huge impact.

41:35

And I don't know what the impact is, because let's see, and that also depends

41:40

very much on how the European Union and Europe reacts to that.

41:46

And I think that's very hard to predict at the moment.

41:50

I do believe it's also important to see he's breaking the rules.

41:56

If he can do it, other leaders will also try to do it. And then they'll figure

42:00

out a degree to which they can do. And that at one point hopefully may establish some new rules,

42:06

maybe even some better rules. Yeah, exactly.

42:09

Yeah, exactly. Kind of, honestly, in general, it's not bad kind of to shake

42:14

up a bit and to disrupt a bit. But kind of, if you give out fundamental rules, all others don't feel bound to the rules anymore.

42:25

Um, and, uh, so this is kind of, you're leaving an equilibrium and you need

42:31

to find a new equilibrium and, uh, that could be very, very painful.

42:35

Uh, the path to that, I guess, or there will be one, if it's better or not, let's see, let's hope.

42:42

Um, and the key question is how long will it take to, to get to that, uh, equilibrium?

42:48

Yes. And it doesn't have to be optimal for everybody else. Everybody knows who

42:52

knows a junk cash equilibrium that basically doesn't have to be optimal for either side.

43:02

But getting off our soapbox here again, going back to VC investment,

43:08

what industries do you think are the most in need of venture capital support

43:13

but are often overlooked? Typically, what I was referring to before, VC has a hurt mentality.

43:23

So they're all moving in one direction or the other direction.

43:27

And typically, this is overemphasizing one thing or the other.

43:31

We're all in consumer. No, they don't like consumer anymore.

43:35

They are all in B2B SaaS, which is also bullshit. So because there is opportunity

43:43

or interesting opportunities in all industries.

43:47

But there's industries I think they're super interesting and I don't see them as I would expect it.

43:54

It's, for example, assistive technology.

43:57

So technology that helps disabled people.

44:02

Because in my mind that would be kind of if kind of you have kind of a disadvantage,

44:08

wouldn't it be great if you have technology that kind of jumps in and kind of

44:14

replaces the disadvantage so that you are at par again?

44:20

And probably it has to do with the market and how it's paid for that,

44:26

but that could be a great opportunity. and a great impact for people.

44:34

And I also guess, though, great economically, also interesting one because it would solve.

44:44

A big challenge and an unsolved problem. Talking about problems here,

44:49

I'm sure you encountered a lot of them in the past and you learned some lessons from this as well.

44:55

I'm talking about the lessons for future entrepreneurs here.

45:01

You know, the typical question is what piece of advice you wish you had received

45:06

before starting Identity VC?

45:08

I remember from the start of our interview, like almost 40 minutes ago,

45:12

that you've been talking how long it takes to raise funding. Yeah.

45:20

One thing is like, forget about institutional investors as an emerging manager.

45:26

We've wasted some time on the institutionals before I learned, forget about them.

45:32

They're not committing to emerging managers. Very, very rare cases.

45:38

You need to raise your first or second fund. you raise on high-network individuals and family offices.

45:49

That's known, and others have the same experience.

45:53

It would have been good if I would have known that before. Then that would have saved us some time.

46:00

I see, I see. Talking about a common misconception of founders about raising

46:08

venture capital, for me,

46:11

In the beginning, it is that every VC invests in every company.

46:16

There are certain focus groups like yours. There are certain industries.

46:21

Plus, there are also stages like early stage, late stage, pre-IPO, and so on and so forth.

46:28

By the way, guys, if any of these terms didn't tell you anything and you're

46:34

about to raise venture capital, maybe you should talk to JetGPT here or do your homework.

46:41

Any other misconception that strike you?

46:46

First of all, adding to the homework before you contact the VC,

46:50

go to the webpage and check what they do.

46:53

Yeah, so sometimes it's like crazy that people do not do the three-second check,

47:01

and what do they do, what do they invest in, and everybody has it on the website,

47:05

and then they contact you. That's a waste of time for both of us. And in terms of misconception,

47:09

I would say it's a distribution of power.

47:13

And many startups or most startups feel kind of there is kind of the VCs have

47:21

much more power and they completely underestimate how big the challenge for

47:27

VCs is also to allocate their money and to deploy their money.

47:32

And so this is much more at eye level than than many, many founders think.

47:40

And VCs are desperately looking for investment opportunities and they have to

47:46

do a lot to find good companies.

47:49

And if you don't get money from a VC or from many VCs, I would kind of need

48:00

to rethink your business model or the way you present it.

48:03

It's not the lake of capital. There's more capital than is needed out there.

48:08

So be aware that VCs kind of also need to kind of pitch you and want to.

48:14

If you don't get money, don't use that as an excuse.

48:19

Then maybe you obviously did something wrong or something is wrong with your

48:25

model or you cannot get that across. Or all VCs are wrong, which I would also could be.

48:32

That also happens. But first, I would look what I can rethink my business model

48:38

or the way I present before I would assume that all VCs are wrong.

48:47

What's the hardest tip for first-time founder about securing their first VC

48:51

check? What would they need as advice?

48:55

Be more relaxed. Be aware of the imbalance of power you just described.

49:02

Yeah, that's more the attitude, how you go into it. But at the end is kind of what you optimize for.

49:09

I did the mistake brutally, kind of don't optimize for valuation,

49:13

optimize for personal fit. It's kind of, this is a one night stand you cannot get out of.

49:19

This is a marriage for 10 years and they are on your cup table.

49:26

So really, really also do your due diligence and think about, can I work with this?

49:36

Typically, it's a person who represents the firm and kind of is a direct contact

49:41

over that firm for the next five, six, seven, eight years.

49:47

And always keep in mind this one TechCrunch article that I have in mind,

49:51

which kind of emphasizes a very important point. more startups have been killed

49:56

by the investors than actually their competition.

50:02

Interesting point of view. I haven't thought about that.

50:07

I don't know that article, but it resonates. Yeah, it resonates.

50:13

Now let's go into the closing and looking a little bit ahead,

50:18

the future of Identity VC.

50:21

What is your long-term vision for the company?

50:24

It's clearly being the European leader in LGBTQ and diversity funding.

50:31

That's one dimension. The other dimension is to create and be the catalyst for

50:39

a strong European LGBTQ startup community.

50:45

That's not there. It's a little bit in the UK. We have that.

50:49

We see that, how that could work in the US. There's organizations like Ganges, like Stardark.

50:54

In Europe, there's still a lot of room to really integrate founders,

51:01

investors across Europe.

51:06

What are you most excited about the next 12 months except the publication of

51:11

this interview? Along the different dimensions.

51:13

So this year, we have around eight more new investments we want to make.

51:19

So this is very exciting and a lot of work, but this is always great to invest

51:26

and have a new company in the portfolio.

51:29

So also founders, if you're looking for LGBTQ founders, if you're looking for capital, contact us.

51:37

And then secondly is we want to do the final closing of the fund in the foreseen future.

51:44

And we have a lot of things on the agenda around the community and what we want

51:52

to achieve and what we want to do. So this was the very short version and just the highlights.

51:58

So we have a very long list, probably more than we can do, but if we achieve

52:06

part of it, that would be great. Awesome.

52:12

Last final questions. How can people reach you? We'll link down here in the

52:17

show notes your LinkedIn profile. Is this a good way to make a first contact?

52:22

LinkedIn, email. Honestly, I'm not a friend of asking for warm intros.

52:29

This is kind of a big problem of the industry, kind of that shows we only want

52:35

to invest in the friends of my friends.

52:39

And that's one reason why this industry is not so diverse.

52:44

And that's kind of same universities, same background, whatever.

52:50

We want to see founders who were not part of that communities and who others might not have seen.

52:58

So you can find my email on our web page. You can contact me via LinkedIn.

53:05

And please do me one favor. If I don't answer at the first time,

53:09

just write a second time.

53:12

Sometimes things get lost. Sorry for that.

53:16

I have the standard receipt check since I had a random idea during the interview

53:22

with Alex from Frankenberg, at the time CEO of Hitech Krümerfonds.

53:26

I asked him, he also sent me an email, and I asked him, would you reply to an

53:32

email that only says, yo, we should talk? Would I reply?

53:39

I don't know. I don't know. It depends. I would say one more keyword would help

53:46

or a LinkedIn profile or one trigger and that's.

53:54

Maybe I would, because this is very rare.

53:57

I don't reply to emails that are not personally addressed to me,

54:02

and there's more than you think. This is hi, comma, blah, blah, blah.

54:07

And you can see that was a mass email. This one is immediately delete.

54:14

I see. Also, that would be a good way for people looking to work with Identity

54:21

VC as part of your staff. Best thing is follow us on LinkedIn.

54:25

That's anyway a good recommendation. Then you're up to date what we invest in,

54:30

what events we do. Kind of we do a lot of community events.

54:33

So we have upcoming events across Europe and also job posts.

54:38

So I would say that's probably the best thing. Follow us on LinkedIn.

54:42

Great. Till, that has been a fantastic conversation.

54:48

I loved it. Thank you very much. And to our listeners, what's a question?

54:53

You would like to ask Till about Venture Capital. Drop your questions down here in the show notes.

54:59

Till, thank you very much. It was a pleasure. Thank you. Pleasure was mine. Thanks for having me.

55:05

And talk soon. Talk soon. Bye-bye. Bye.

55:13

That's all, folks. Find more news, streams, events, and interviews at www.startuprad.io.

55:23

Remember, Sherry is Carrie.

55:26

Music.

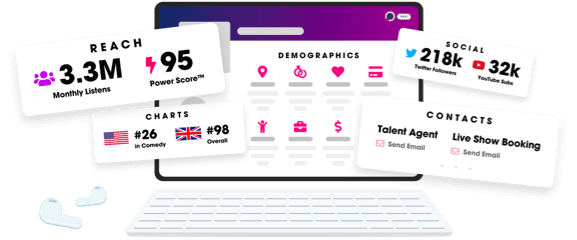

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us