David Clark welcomes back Andrew Lockhart, Managing Partner of Metrics Credit Partners — one of Australia's largest private lenders and a major force shaping the future of private credit. With private credit markets booming — and critics warning of bubbles and risks — David and Andrew explore why private credit can play a critical role in a high-net-worth portfolio when approached with discipline and scale.

They dive deep into the key metrics that investors should evaluate in private credit, including loss rates, diversification, liquidity management, and risk-adjusted returns. Andrew explains why Metrics' institutional-grade processes, governance standards, and proactive credit management position it at the centre of Australia’s private credit growth story — and why careful manager selection has never been more important.

With insights into Metrics' $23 billion portfolio, how private credit compares to traditional bank lending, and how Metrics navigates the evolving regulatory landscape, this episode is essential listening for investors seeking income, stability, and diversification in today’s uncertain markets.

Get a behind-the-scenes look at why Metrics is thriving amid industry scrutiny.

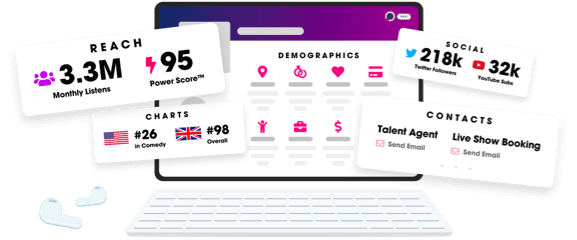

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us