Episode Overview

IIn this episode, I explore the wealth gap that exists in the UK (where 45% of men hold stocks and shares ISAs compared to only 26% of women) and challenge us to reconsider what wealth truly means beyond the traditional definition of "assets minus liabilities."

Key Highlights

The Limited Definition of Wealth

- Financial services and media have long defined wealth purely in numerical terms

- This definition feels meaningless to most women's lived experiences

- While money is important for basic needs, true wealth encompasses much more

- Our language around money shapes our beliefs and actions

Redefining Wealth as Collective

- Wealth isn't just an individual pursuit but a collective experience

- It involves investing in companies that build wealth for society

- It includes experiences that create a deep sense of belonging

- True wealth makes us feel whole, enriched, and equal

The £2 Million Question

- I explored reactions to the question: "What if I transferred £2 million into your account?"

- Common responses revealed deep-seated money beliefs:

- "Where are the strings attached?"

- "That's too much responsibility"

- "I need to give it away/share it"

- "I don't deserve this"

- These reactions stem from conditioning about our relationship with money

When Money Feels Dangerous

- Many of us have experiences where money created problems:

- Earning well but experiencing burnout

- Relationship tensions when financial dynamics shifted

- Friendship groups judging increased wealth

- Feeling disconnected from loved ones due to financial differences

- These experiences create unconscious success ceilings

The Perfectionism Trap

- Fear of making imperfect money decisions leads to paralysis

- Sharing my personal story of buying property just before the 2007-2008 crash

- How past "mistakes" create lasting stories about our financial decision-making abilities

- We often spend money quickly to avoid the responsibility of making "perfect" decisions

Breaking Through Money Blocks

- Growing wealth is less about strategy and more about emotional capacity

- Our ability to hold more responsibility, trust ourselves with money

- The importance of recognising all the good financial decisions we've made

- The first step of the Money Narrative Clearing Method: awareness

The Six-Step Money Narrative Clearing Method

- Awareness as the crucial first step in transformation

- Identifying patterns in our relationship with holding wealth

- Recognising the emotions behind our money stories (guilt, shame, judgment)

- Building trust that money can be a positive tool aligned with our values

Final Thought

It's time to unlearn narratives like "you don't deserve wealth," "it's too complicated," or "it's greedy to want more." Wealth should be defined not by what we've been told, but by what makes us feel whole, enriched, and empowered.

Chapters

00:00 Redefining Wealth: A New Perspective

06:11 The Emotional Connection to Money

12:02 Overcoming Limiting Beliefs About Wealth

18:12 Creating a Safe Space for Wealth

24:05 Your Personal Definition of Wealth

Resources:

Get my FREE book 'It's Not About The Money'

Take the Money StoryTypes® Quiz

Sign up to my FREE Newsletter

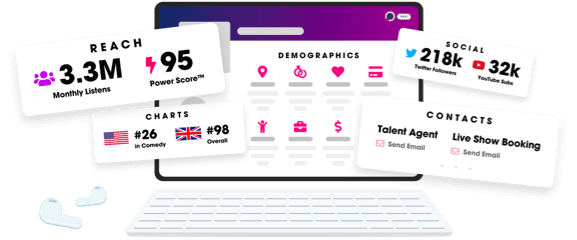

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us