Marketplace

Episodes of Marketplace

Mark All

The stock and bond markets may tumultuous right now, but gold prices have been on a tear. This week, they hit an all time high of $3,500 an ounce. In this episode, why nervous consumers, investment firms and even central banks are trading in ca

The Treasury’s Community Development Financial Institutions Fund supports lenders in far-flung and underserved areas. It also made a laundry list of federal programs President Trump deemed unnecessary and ordered to be “eliminated” last month.

Trump’s tariffs will touch the vast majority of industries, but apparel — clothes, shoes, accessories — will be particularly impacted. Around 98% of clothing sold in the U.S. is imported, primarily from China. In this episode, we look at how ta

Verizon lost nearly 300,000 monthly phone subscribers in the first quarter. The telecom giant put partial blame on ongoing government layoffs. Verizon will bounce back, analysts say, but its bad news may be followed by similar corporate disclos

The scale and volatility of the trade war may be surprising, but tariffs aren’t new — unless you’re an aircraft manufacturer. (A trade agreement eliminated duties on commercial jets in 1980.) Last week, China told its airlines to reject Boeing

Stop us if you’ve heard this before: We’re in an unprecedented economic moment. But this time really is different. America’s place in the global economy is shifting, and what happens next is going to matter for businesses, consumers and you. Th

Some relief seems to have arrived on the housing shortage front — listings are up 9% compared to last year. But buyers who’ve been waiting for more properties to go on the market? Not many are biting. In this episode, why the housing market fli

First-time jobless claims have been pretty stable since the start of March — unlike many other parts of the economy. President Donald Trump’s tariffs and immigration restrictions may not be ideal for businesses, but they could give companies a

We’ve heard about people rushing to replace big-ticket essentials ahead of trade war-related price hikes, but what about stuff that’s more of a want than a need? In this episode: Tariff anxieties shape discretionary spending, giving consumers a

For the first few years of the pandemic, businesses navigated a backed-up global supply chain that left some with excess inventory and others with no inventory at all. Tariffs may cause similar issues: Companies are stocking up on imports, and

Fear of unemployment jumped 4.6 percentage points to 44% in March, according to a New York Fed survey. That’s the highest it’s been since April 2020. Expect the commercial real estate market to feel that same vibe. Companies concerned about a t

Just like some people fudge the numbers to lower their taxes, some companies do the same when paying tariffs on foreign goods. The federal government is mostly trusting that what’s in that shipping container is actually 100 bicycles, and not 50

Stocks aren’t the only assets in the financial markets that were beat up this week by President Trump’s tariffs. Bonds suffered too. After 3-year Treasury yields rose in the face of disappointing demand, bond investors are scrutinizing Treasury

We’ve said it more than once lately: This economy is defined by uncertainty. And as President Trump makes aggressive, if erratic, moves on trade and federal funding, firms and organizations are taking action to protect their interests. In this

The issuance of corporate bonds has slowed to a crawl, thanks to all that uncertainty in the economy. And without raising money in the bond market, firms may pull back on long-term investments. Also in this episode: The Democratic Republic of t

Import levies on Chinese goods amount to 54% right now. But some things that China excels at producing will likely remain in China. In this episode, why shoemaking can’t up and leave anytime soon. Plus: Copper prices ballooned and tanked in the

Tariff-driven inflation will hit Americans with the lowest incomes the hardest, slashing their disposable income by at least $1,700 a year, the Yale Budget Lab predicts. We’ll explain why. And the labor market could suffer too if demand falls

Uncertainty about tariffs and trade policy has been top of mind since President Donald Trump’s election in November. We finally know how high those tariffs will be (between 10% and 54%) and to which countries they’ll apply (almost all of them).

Corporate dealmakers hoped merger and acquisition ventures would heat up this year. But the first quarter of 2025 saw the slowest M&A activity in more than a decade, according to Dealogic. In this episode, why firms aren’t shelling out billions

People feel richer — and spend accordingly — when their assets rise in value. That’s called the wealth effect. But when folks get their retirement account statements for Q1 of 2025, they may feel the opposite, since most of those accounts lost

Just how expensive has homeownership become? To afford a typical home, households need an income of about $117,000 right now — a 50% increase from $78,000 in January 2020, according to a Bankrate report. Over the same five years, wages rose ju

Consumers say they’re fed up with inflation, then they keep spending. But their behavior could be catching up with their anxiety, an economist told us. The clues are in data released today by the Commerce Department. Also in this episode: Can y

The U.S. economy grew at a 2.4% annual rate in the fourth quarter of 2024, the Bureau of Economic Analysis reported today. That number tells us where the economy was headed coming into this year. But with uncertainty surrounding tariffs, that s

More tariffs are on the way, this time targeting vehicle imports. President Donald Trump favors import taxes, partly because, he argues, they’ll help shrink the U.S. trade deficit. But if tariffs cut Americans’ spending on imports, foreigners a

The latest reading marks the fourth straight month of declining consumer confidence, and it fell more than expected. How will the souring mood affect spending and the job market? Also in this episode: Political economist Mark Blyth discusses ho

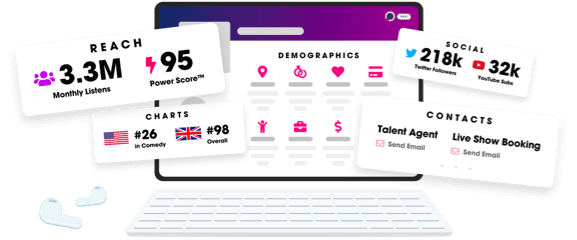

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us