Learn how to prepare for a possible recession and make sure your car insurance coverage is enough to protect your finances.

What should you do to get ready for a recession? How much car insurance coverage do you really need? Hosts Sean Pyles and Elizabeth Ayoola discuss recession risks and car insurance basics to help you understand how to protect your finances. Joined by NerdWallet senior news writer Anna Helhoski, they begin with a discussion of recession warnings, with tips and tricks on budgeting with the 50/30/20 rule, building an emergency fund, and prepping your credit and savings.

Then, insurance Nerd Lisa Green joins Sean and Elizabeth to discuss how to choose the right amount of car insurance. They discuss the difference between liability, collision, and comprehensive coverage, what minimum insurance limits really protect you from (and what they don’t), and how umbrella policies and uninsured motorist coverage can add extra protection. You’ll also hear ways to lower your car insurance bill by shopping around, raising your deductible, and finding overlooked discounts.

Compare auto insurance rates in 2 minutes with NerdWallet’s auto insurance finder: https://www.nerdwallet.com/insurance/l/auto-insurance-finder

In their conversation, the Nerds discuss: how to prepare for a recession, signs of a recession, what happens during a recession, 50/30/20 budget rule, building an emergency fund, credit during a recession, umbrella insurance, what is umbrella insurance, car insurance basics, collision vs comprehensive coverage, liability car insurance explained, full coverage car insurance, what is full coverage insurance, auto insurance deductible, underinsured motorist coverage, car insurance tiers, how to save on car insurance, shopping for car insurance, car insurance comparison tips, high liability coverage, car insurance for old cars, what is property damage liability, what is bodily injury liability, best car insurance coverage, understanding insurance limits, home and auto umbrella policy, recession impact on prices, recession and interest rates, how long recessions last, economic indicators of recession, consumer sentiment recession, car insurance for risky drivers, and auto insurance discounts.

To send the Nerds your money questions, call or text the Nerd hotline at 901-730-6373 or email podcast@nerdwallet.com.

Like what you hear? Please leave us a review and tell a friend.

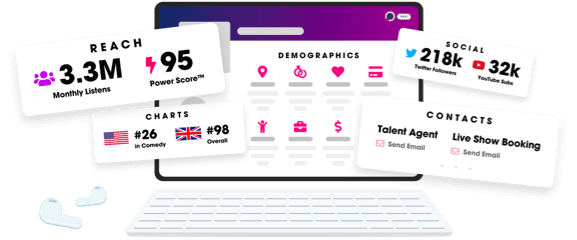

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us