Portable alpha (or as we like to call it: Return Stacking) has become increasingly popular in the financial media (including recent notes from industry giants like BlackRock, Russell Investments, and AQR) but many advisors are left asking: What does portable alpha mean? How might it benefit clients? How can I implement it?

At Return Stacked Portfolio Solutions we have made it our mission to thoughtfully and transparently help allocate into a portable alpha framework for client portfolios.

Join us for this deep dive podcast with Corey Hoffstein, CIO of Newfound Research, and Rodrigo Gordillo, President and Portfolio Manager at ReSolve Asset Management Global, as we explore:

- What 'Portable Alpha' is: Review of the history and theory of the concept.

- Outperformance Potential: Portable alpha/return stacking allows allocators to stack asset classes/strategies with positive expected returns on top of core assets which can help improve the likelihood of outperforming the market.

- Diversification Benefits: Using return stacking to stack low correlation strategies on top of the core portfolio can help reduce portfolio drawdowns, thus influencing likelihood of achieving financial plan goals.

- Behavioral Benefits: Sticking with low-correlation diversifiers can be difficult for clients. Return stacking can improve the likelihood clients stick with diversifiers long enough for them to realize the benefits.

*ReSolve Global refers to ReSolve Asset Management SEZC (Cayman) which is registered with the Commodity Futures Trading Commission as a commodity trading advisor and commodity pool operator. This registration is administered through the National Futures Association (“NFA”). Further, ReSolve Global is a registered person with the Cayman Islands Monetary Authority.

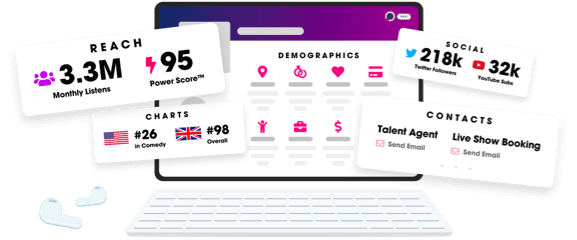

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us