In this episode of 'Retire with Style', hosts Alex Murguia and Wade Pfau delve into the complexities of Roth conversions, discussing strategies, constraints, and the importance of diversified accounts. They explore how to approach Roth conversions effectively, considering factors like income needs, tax implications, and the innovative concept of tax mapping to optimize retirement planning. They also delve into the complexities of tax planning, particularly focusing on the tax map concept, effective marginal tax rates, and the strategic importance of Roth conversions. Their discussion also touches on how various income sources, including Social Security and investment income, interact with tax brackets and surcharges, ultimately influencing retirement planning and legacy outcomes. The dialogue emphasizes the need for personalized strategies to optimize tax efficiency and legacy value, while also addressing the nuances of tax law changes and individual circumstances. Listen now to learn more!

Takeaways

- Roth conversions should be viewed as a hedging strategy.

- It's important to frontload Roth conversions when possible.

- Constraints like RMDs and taxable income affect conversion decisions.

- Tax mapping can clarify how much to convert and when.

- A conservative approach to conversions can mitigate risks.

- The effectiveness of Roth conversions depends on future tax rates.

- Planning should adapt as circumstances change over time.

- Opening a Roth account early is beneficial for future flexibility. The tax map helps visualize how ordinary income affects tax rates.

- Effective marginal tax rates can be higher than nominal rates due to Social Security taxation.

- Roth conversions can be strategically beneficial to manage future tax liabilities.

- Targeting specific effective marginal tax rates can optimize legacy outcomes.

- Tax planning should consider both current and future income scenarios.

- Low income years present unique opportunities for Roth conversions.

Chapters

00:00 Introduction to Roth Conversions02:11 Understanding Roth Conversion Strategies10:18 Constraints in Roth Conversion Decisions16:33 The Importance of Diversified Accounts20:14 Exploring Tax Mapping Concepts23:04 Understanding the Tax Map and Income Generation27:03 Navigating Tax Brackets and Effective Marginal Rates29:36 The Importance of Roth Conversions31:15 Evaluating Tax Rate Targets for Optimal Legacy35:48 Strategies for Roth Conversions and Tax Planning41:28 Identifying Opportunities for Roth Conversions

Links

The Retirement Planning Guidebook: 2nd Edition has just been updated for 2024! Visit your preferred book retailer or simply click here to order your copy today: https://www.wadepfau.com/books/

This episode is sponsored by Retirement Researcher https://retirementresearcher.com/. Download their free eBook, 8 Tips to Becoming A Retirement Income Investor at retirementresearcher.com/8tips

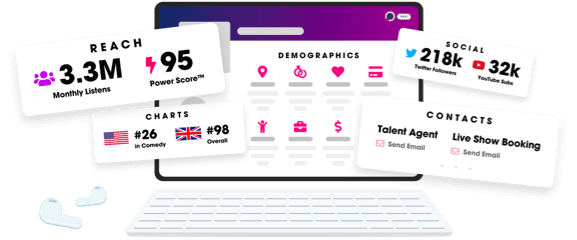

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us