Welcome Back! In this episode, Alex, Wade and Brian dive into the complexities of financial planning, focusing on return assumptions, the importance of a living financial plan, and the methodologies behind capital market assumptions. They discuss the balance between spending and saving in retirement, the relevance of the 4% rule, and practical recommendations for effective financial planning. The conversation emphasizes the need for stress testing and understanding the underlying assumptions in financial models to ensure realistic and effective planning. Listen now to learn more!

Takeaways

- Return assumptions can be based on historical or expected returns.

- The financial plan should be treated as a living document that evolves over time.

- Methodologies for capital market assumptions can vary significantly between firms.

- The 4% rule is less relevant in modern financial planning than it used to be.

- Stress testing financial plans helps to understand potential outcomes and risks.

- Communication with clients about their financial goals is essential.

- Understanding the math behind financial planning is as important as the goals themselves.

- Advisors should guide clients in making informed decisions about spending and saving.

Chapters

00:00 Historical vs. Expected Returns in Planning04:14 Building Capital Market Assumptions07:15 Balancing Lifestyle and Financial Planning11:01 Understanding Spending Behavior in Retirement13:36 The Relevance of the 4% Rule17:26 Practical Recommendations for Financial Planning

Links

Click here to watch this episode on YouTube: https://youtu.be/R1dNHo3BDNA?si=RiNVF21TG9Zh4Npf

The Retirement Planning Guidebook: 2nd Edition has just been updated for 2025! Visit your preferred book retailer or simply click here to order your copy today: https://www.wadepfau.com/books/

This episode is sponsored by McLean Asset Management. Visit https://www.mcleanam.com/retirement-income-planning-llm/ to download McLean’s free eBook, “Retirement Income Planning”

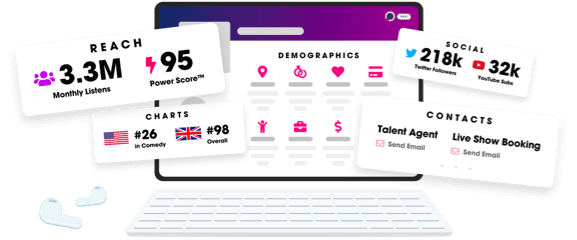

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us