In this episode of The Future of Finance, Georges Dyer sits down with Claire Quigley, Client Portfolio Manager, Sustainability Solutions at Ethic, to explore the evolving landscape of sustainable investing. Claire shares how Ethic helps investors—including institutional investors like endowments and foundations—align their portfolios with their missions while achieving their risk-adjusted returns targets.

They discuss the power of shareholder activism, the role of transparency in ESG investing, and how data-driven strategies shape investment decisions. Claire also sheds light on how Ethic customizes passive equity portfolios, engages in proxy voting, and navigates the challenges and opportunities in sustainable finance.

Tune in for an insightful conversation on the future of sustainable investing, how institutions can build consensus around impact priorities, and why finance has a critical role to play in shaping a more sustainable world.

Keywords:

sustainable investing, mission aligned investing, values alignment, Ethic, shareholder engagement, passive equity, financial returns, impact investing, climate change, ESG, investment strategies

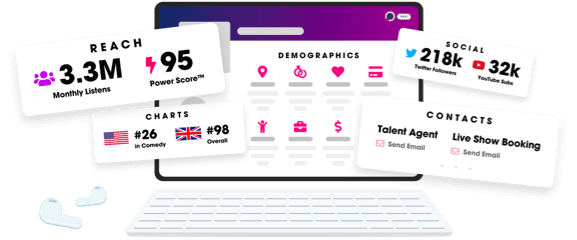

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us