Confused by Amazon’s PE ratio? Financial educator Brian Feroldi breaks down the six stages of a company’s life and reveals why traditional valuation metrics often fail. Learn how to analyze any stock, avoid common mistakes, and discover the tool that makes investing easier for everyone.

[00:01:00] Why PE ratio fails for Amazon and growth stocks. [00:03:00] The six stages of a company’s business lifecycle explained. [00:07:00] How to spot startups and hypergrowth companies in the market. [00:11:00] Self-funding phase: when companies stop needing outside capital. [00:13:00] Operating leverage: profits grow faster than revenue here. [00:16:00] Capital return phase: dividends, buybacks, and mature companies. [00:19:00] Three key numbers to identify a company’s current stage. [00:26:00] Why Amazon’s valuation needs a different metric approach.

Timestamps are generated by artificial intelligence, and are not 100% accurate depending on the platform used for listening.

Today’s show is sponsored by:Go to SHOPIFY.COM/beginners to start selling with Shopify today.

Check out the Stock Simplifier here: Stock Simplifier.

What do Dave and Andrew recommend?

Andrew works really hard to find the best insights he can every single month at Value Spotlight. To see a sample of his previous work, go to stockwriteup.com.Have questions? Send them to newsletter@einvestingforbeginners.com

SUBSCRIBE TO THE SHOWApple | Spotify | YouTube | Amazon | Tunein

For sponsorship inquiries, reach out to us at equity@einvestingforbeginners.com.Learn more about your ad choices. Visit megaphone.fm/adchoices

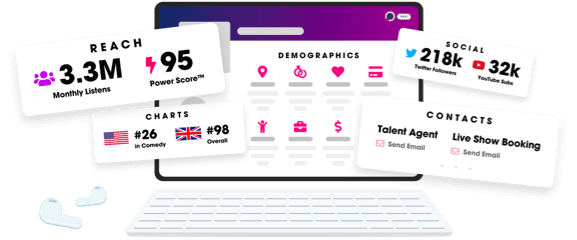

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us