If you are considering financing for your small business or feeling unsure which type of financial institution might be best to work with, this episode of Small Business Matters is just for you as we focus on small business finance. We sat down with executives from four different financing companies ranging from Fintech, to CDFI, to Equity Crowd Funding and Traditional Brick and Mortar banks to talk about how they serve small businesses. Fintech Standout Biz2Credit Streamlines Funding Process for Small Business Segment #1 0:58 Rohit Arora is one of the country's leading experts in small business finance. His company, Biz2Credit, uses technology to streamline business funding. We talk about the origins of FinTech, their VirtualCFO platform, which enables small business owners to benchmark how they are doing to other businesses in their space, and what’s driving growth for fast, convenient online funding, and why more small businesses are turning to FinTech lenders. Rohit Arora on LinkedIn CDFI’s Provide Myriad Assistance to Small Businesses and Entrepreneurs Segment 2 9:43 CDFI stands for Community Development Financial Institution, they are mission-driven community resources of financing for small businesses, and they play a crucial role in the financial ecosystem. We spoke with Mark Pinsky, Founding Partner of CDFI Friendly America, an organization determined to help existing CDFI’s serve bigger markets. In our discussion, we talked about what characteristics CDFI’s look for in small businesses and entrepreneurs they work with, and what CDFI has planned for major city expansions in places like Fort Worth, Texas. Mark Pinsky on LinkedIn Seed at the Table Offers Innovative Crowdfunding for Small Businesses and Investors to Help Close the Racial Funding Gap Segment 3 23:00 Seed at the Table is a mission-driven crowdfunding platform committed to connecting diverse entrepreneurs with investors. They raised $1.3 million in less than a year for businesses founded by women, and people of color. Co-Founder Suzen Baraka sat down with Experian’s Emily Garman to talk about their mission, and some of the early successes they had in closing the racial funding gap. Suzen Baraka on LinkedIn First Citizens is Banking on Strong Relationships with Small Businesses Segment 4 31:00 As America's largest family-controlled bank, First Citizens Bank has been supporting consumers and small businesses across the US for more than 120 years. They operate more than 600 locations in 22 states and recently merged with CIT Group, making them one of the top 20 US banks. We spoke with the bank’s Senior Director of Business Credit, Phil Hains, about how they support small businesses, what a small business should have in place before seeking funding, and how the bank is embracing Diversity, Equity and Inclusion in their branches through their bankers and the greater small business community. Phil Hains on LinkedIn For any resources mentioned on the show today, visit our show notes over at experian.com/smbmatters. Want to help us grow? Drop us an honest review and rating on whichever platform you are listening on. FOLLOW US Twitter Instagram LinkedIn YouTube

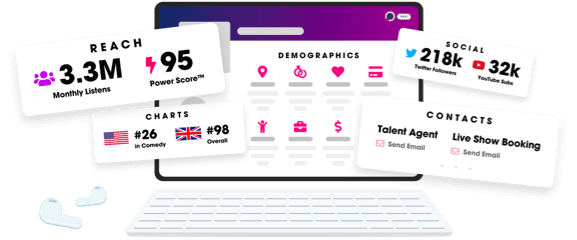

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us