In this episode, I speak with Arpan Gautam from Noon Capital — a self-funded project building what they call the most intelligent and fair yield-bearing stablecoin. We dive into how their stablecoin (USN/sUSN) delivers through-cycle returns by allocating capital across delta-neutral strategies, and why they’re committed to distributing 90%+ of returns and up to 80% of governance tokens back to users.

We also discuss how Noon Capital avoids the pitfalls of treasury-only stablecoins, why they’ve rejected VC funding, and Arpan’s advice for founders on staying focused and aligned as a team.

Whether you're a DeFi builder, an investor in yield-bearing assets, or just curious about the next generation of stablecoins — this is a must-listen.

Key Timestamps

[00:00:00] Introduction: Sam introduces the episode with Arpan from Noon Capital and outlines the focus on stablecoins and DeFi.

[00:01:00] What is Noon Capital?: Arpan explains their mission to build a fair and intelligent yield-bearing stablecoin.

[00:03:00] Yield Intelligence: How Noon adapts across market cycles using delta-neutral strategies.

[00:05:00] Fairness via Governance: Noon distributes up to 80% of governance tokens to users — no VC involvement.

[00:06:30] Arpan’s Background: From McKinsey and Goldman to crypto trading and stablecoin design.

[00:09:00] The Origin Story: How Noon spun out from prop trading into product.

[00:11:00] Performance: Past returns and how Noon balances between T-bills and funding rate arbitrage. [00:13:30] Users & Growth: Why institutional LPs are first movers and how retail follows.

[00:16:00] Market Indicators: What data Noon tracks to stay ahead — from Fed signals to Bitcoin open interest.

[00:17:30] USN vs SUSN: The difference between Noon’s staked and unstaked stablecoins.

[00:19:00] Scaling Challenges: Growing TVL and building composability in DeFi and beyond.

[00:21:00] Founder Advice: Arpan shares a simple but powerful rule — one North Star goal for the entire team.

[00:23:00] Ask: Noon is looking to connect with liquid funds, whales, and builders — but remains proudly self-funded.

Connect

https://www.linkedin.com/company/nooncapital/

https://www.linkedin.com/in/arpan-gautam/

https://x.com/noon_capital

Disclaimer

Nothing mentioned in this podcast is investment advice and please do your own research. Finally, it would mean a lot if you can leave a review of this podcast on Apple Podcasts or Spotify and share this podcast with a friend.

Be a guest on the podcast or contact us - https://www.web3pod.xyz/

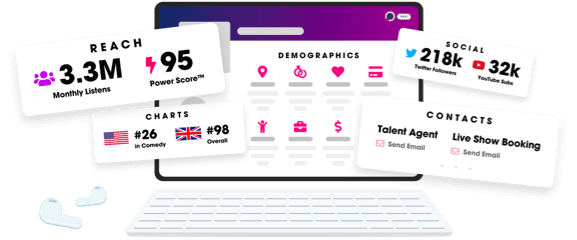

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us