Episode Overview

In this episode, I tackle the timely topic of investing during market volatility, particularly relevant as stock markets respond to President Trump's recent tariff announcements. For many investors, these uncertain times can trigger anxiety and fear, but I explain why volatility is actually normal, cyclical, and can present excellent investment opportunities for those with the right knowledge.

Key Highlights

Understanding Market Sentiment

- Warren Buffett's famous advice: "Be fearful when others are greedy and greedy when others are fearful"

- The Fear and Greed Index as a valuable tool for measuring collective investor emotions

- How buying during periods of extreme fear has consistently produced strong returns over time

- The counterintuitive nature of successful investing - why it feels uncomfortable to go against the crowd

The Psychology of Market Cycles

- Market sentiment follows predictable emotional patterns:

- Disbelief → Hope → Belief → Thrill/Euphoria

- Complacency → Anxiety/Denial → Panic → Depression

- Then back to Disbelief as the cycle restarts

- Understanding where you personally get caught in this emotional cycle

- Common behavioural biases that affect investment decisions:

- Loss aversion (feeling losses twice as strongly as gains)

- FOMO (fear of missing out)

- The endowment effect (overvaluing what we already own)

Recognising Your Own Emotions and Behaviours

- Self-awareness as the most underrated investment skill

- Research shows individual investors underperform markets by 2-4% annually due to emotional decisions

- The value of keeping an investment journal to document feelings during market cycles

- Understanding your risk tolerance and personal biases

Understanding Market Cycles

- The four classic phases of economic cycles: Expansion, Peak, Contraction, Recovery

- Different market sectors that typically outperform in each phase:

- Expansion: Technology, consumer-based stocks

- Peak: Financial sectors, industrial stocks

- Contraction: Healthcare, consumer staples, utilities

- Recovery: Materials, energy sectors

- How to adjust portfolio weightings based on cycle phases

The Power of Correlation in Building Resilience

- Correlation measures how different assets move in relation to each other

- Understanding correlation coefficients: from -1 (opposite movement) to +1 (same direction)

- Why true diversification requires assets with low correlation to each other

- The 2022 example of both bonds and equities declining simultaneously

- Building a portfolio that can weather different market conditions

Final Thought

Successful investing is about time in the market, not timing the market. Research shows that missing just the 10 best days in the stock market can cut returns in half over decades. While market volatility might make many investors fearful, those prepared with the right strategies can use uncertain times as opportunities for growth.

Chapters

00:00 Investing in Uncertain Times

04:49 Understanding Market Sentiment

09:08 The Psychology of Market Cycles

16:20 Recognizing Personal Emotions in Investing

18:11 Understanding Market Cycles

21:33 The Importance of Correlation in Investments

25:52 Key Strategies for Successful Investing

Resources:

Get my FREE book 'It's Not About The Money'

Take the Money StoryTypes® Quiz

Sign up to my FREE Newsletter

Come to our Wealth Awakening Retreat

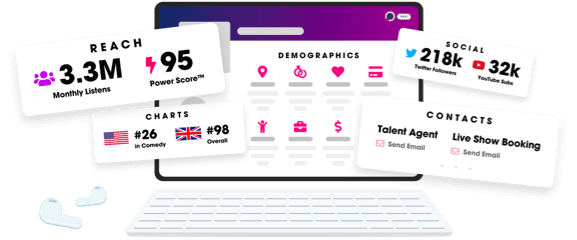

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2025 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us